Is Skrill Safe

What is Skrill Money Transfer? Read this article where is it explained how a Skrill account works. Skrill is a regulated company and. Find the best betting guides and depositing tutorials for sports betting in India including Cricket, Football and eSports. Bet Online in India 2021. Paying for things with your mobile is easy and safe with Skrill.

Intro

We always keep your payments and personal information safe and our anti fraud team protects every transaction INSTANT It s easy for Skrill wallet.

As one of the most recommended e-money transfer platforms in the industry today. Skrill has continued to impress its clients with simple, secure, and quick digital payments. Being the U.K.’s oldest digital payment services provider has pushed Skrill to continue to be a digital transaction pioneer. Trusted by businesses and individuals around the world, this company orchestrates billions of dollars’ worth of transfers each year.

Skrill India Review

| Firm | Paysafe Group Ltd. Company no.109535C |

| Official Website | https://www.skrill.com/en/ |

| Since | 2001 |

| Regulation | Financial Conduct Authority (UK) |

| Platform Type | E-Money/ Transfer |

| Mobile Platform | Yes |

| Compatibility | Mac OS, Windows, IOS, Android |

| Free Account | Yes |

Skrill Fees

| Personal Transaction Fee | 1.45% |

| Currency Exchange Fee | 3.99% |

| Withdrawal/ Receiving Fee | 7.5-11% |

| Total Fees | 13-16.5% |

| Transfer Limit | $10,000 |

What is Skrill?

Skrill has been working diligently to provide the best digital payments service since 2001; as an acknowledged world-leader in developing global payment solutions for people’s business and pleasure, whether they’re depositing funds on a gaming site, buying online or sending money to family and friends. Services also meet the needs of businesses worldwide, helping them build a global customer base, and drive growth.

Based in London and offices throughout Europe and the US, our staff of over 500 represents more than 30 nationalities, Skrill is a truly global company.

Is Skrill Safe & Reliable

A subsidiary of Paysafe Group Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money. Authorized by the Financial Conduct Authority in the UK, Skrill upholds the highest standards throughout its business and services around the world.

What Makes It Special?

Skrill accounts can be created in one of 40 supported currencies with the ability for some to add more currencies to the account later on. Unlike many other e-money platforms, Skrill allows VIP clients to have more than one fiat currency in his or her wallet. This allows users to be paid in and spend different currencies all from the same place.

To have access to funds while on the move customers can purchase a Skrill prepaid card, linked to their account, in one of these four currencies: USD, EUR, PLN, and GBP.

High-turnover customers are offered premium membership called “Skrill VIP” that includes additional features, such as a security token, multi-currency accounts and the ability to earn loyalty points. Rewards programs for all users like Knect give this company a leg up on much of the competition.

Skrill: Sign Up/ Open an Account from India

Becoming a Skrill client is simple from India; to open an account fill in your name, email address, and password. Once open the country and currency must be selected: after a currency has been chosen it cannot be changed. Complete the KYC requirements to prove that you are a real person.

Skrill Account Verification from India

Complete the Anti-Money Laundering requirements with your name, address, and phone number after selecting your method of deposit. Once the information has been entered into the system verification should be complete. After successful initial verification clients are able to deposit, transfer, and withdraw money. Funding your account, linking a social media platform, and ID verification are all a part of the process.

How to Make a Skrill Deposit from India

In India, deposits are most often made by credit or debit cards. Internationally deposits and withdrawals could not be easier; with about 40 different deposit options anyone could make use of the account. Different countries are provided different deposit methods; choose the best based on your situation.

How to Withdraw Money from Skrill to an Indian Bank Account

Customers can withdraw funds from their accounts by bank transfer or to a Visa credit card. Money is typically withdrawn to the same account or card used to deposit money. In India people most often use a credit or debit card.

Skrill VIP

This platform provides users with four levels of membership, each with benefits ranging from dedicated support, lower fees, and higher transaction limits.

Skrill Mobile App

The mobile app allows customers to spend, send, and receive on the move. Available on the Apple App and Google Play Stores, it is a great way to maintain access to your money and cryptocurrencies anywhere. Highly rated in both stores, Skrill’s app keeps clients happy.

Conclusion

Skrill stands out above its competition in part thanks to the company’s determination to be the fastest, simplest, and most secure transfer service in the world. The merchant network, client security, and the sophisticated mobile app combine to create a top notch transfer platform.

Check out Skrill today and unleash you money.

Skrill is tied closely to the gambling and cryptocurrency industries. It is expensive and offers poor customer support. Avoid if you can.

What we like

- Ability to link a debit MasterCard

- Digital currencies are available

What we don’t

- Confusing pricing structure

- Expensive

- Difficult to contact customer service

Skrill has been around for much longer than most online money transfer services. Born at the peak of the tech boom in the early 2000s, its business model has changed over time as it adapted to the needs of its customers.

Beginning with low-value remittances, Skrill has innovated in non-traditional sectors. In recent times, this has seen a heavy focus on building a platform to support the gambling and cryptocurrency industries.

To learn more about this service and see if it’s right for you, read on for our in-depth Skrill review.

Affiliate disclosure: If you sign up with a money transfer service after being referred from our website, we might earn a referral fee. Learn more.

About Skrill Money Transfer

What is Skrill Money Transfer all about? Let’s begin our Skrill review with some general information about the service.

Company profile

Skrill was founded in 2001 by Daniel Klein and Benjamin Kullmann, as an internet-focused payment service. Originally called Moneybookers, the company was established during the race to develop the first digital wallet; a race that was eventually won by PayPal. Their growth in recent times is largely as as a result of integrations with platforms such as Facebook, Skype and eBay, as well as an increasing focus on gambling.

The ownership of Skrill has changed a few times over the years. In 2007 the company was purchased by Investcorp Technology Partners. Then, in 2015 Skrill was acquired by what would become to be known as the Paysafe Group for €1.2 billion. The group briefly listed on the London Stock Exchange before eventually being sold to a consortium of private equity investors in 2017.

Skrill is currently led by Lorenzo Pellegrino, who is supported by Paysafe Group CEO, Joel Leonoff. The Paysafe Group is lucky enough to have a wealth of experience, including Danny Chazonoff as Chief Operating Officer and Elliott Wiseman as Chief Compliance Officer. More specific to the Skrill side of the business, Fayyaz Ansari is CFO of Digital Wallets.

Head office

Skrill is headquartered at the following address:

Skrill Limited

25 Canada Square, Canary Wharf

London E14 5LQ

United Kingdom

International offices

Skrill has established local offices in the following countries:

- United States

Supported countries and currencies

Skrill Money Transfer supports the transfer of funds to approximately 35 countries. For the most part, the service facilitates its transfers using the SWIFT network, which allows it to deliver funds to all corners of the globe. The downside to this network is that there are often charges incurred by the recipient, of which Skrill has little control of.

Skrill account limits

Skrill has a minimum transfer value of £1. The maximum transfer value is £10,000, so the service is only suitable for smaller amounts.

Skrill fees and exchange rate

What are Skrill fees and exchange rates? To properly consider this question, it will take a few minutes to explore the foreign exchange market.

How the foreign exchange market works

Let’s begin with how the foreign exchange market works. Banks and other money transfer services will buy foreign currency at a price very close to the mid-market rate. They will then sell this currency to you, the customer, for a higher rate than they bought it for, taking a margin in between – known as “the spread”.

The spread is essentially a hidden cost that is not disclosed to you during the transaction. Then, in addition to the spread, some services will charge a transaction fee on top – which is typically the fee that they quote to you. In any case, the total cost of a transfer for you, the customer, is the combination of the two; the spread + transaction fee.

Q. Does the Skrill exchange rate include a spread?

A. Yes, there is a spread.

Q. What about Skrill fees?

A. No, there is no transaction fee.

But for the moment, don’t pay too much attention to the details. Rather, for the purpose of our Skrill review, let’s consider the overall cost.

Why focus on overall cost?

If you focus on the spread or transaction fee in isolation, it is easy to become lost in marketing gimmicks. Instead, it is more helpful to consider the overall cost when these factors are combined. For example, a typical bank will charge up to 5% of the overall transfer value in spread and transaction fee to complete a transfer on your behalf. Not great.

But what about Skrill Money Transfer? To determine its overall cost we need to compare a transfer with a benchmark, the mid-market rate, which in theory has no cost. Practically speaking, it is unlikely that you will ever receive the equivalent of the mid-market rate, however, your goal should be to get as close as possible.

If you can achieve a total cost of less than 1% of the overall transaction value then you are on the right track. However, it really depends on what your needs are and if you are willing to pay a little bit extra for additional features, advice, or research. To find out the mid-market rate of any currency pairing, use this calculator at xe.com.

What is the cost of Skrill?

To calculate the cost of Skrill, we received three quotes to exchange British Pounds (GBP) into Euro (EUR) – for low, medium, and high values. The overall cost of each transaction was then compared against the mid-market rate and represented as a percentage of the transfer value.

Here is the calculation:

An average cost of 1.04% means that for every £1,000 sent, on average £10.40 will be lost in spread + fees. By using this figure, we can make a general representation of Skrill across a range of transfer values. Of course, it is not a perfect representation by any means, but it is helpful for comparative purposes.

Important note on SWIFT: You should be aware that any transfer conducted via the SWIFT network may incur additional hidden charges by correspondent banks; the exact cost depending on the amount of the transfer and the recipient bank. In our experience, these fees can be as high as £25 per transaction.

Skrill review: Market comparison

SO, how does Skrill compare to other services in the market? To help you determine its relative competitiveness, we have prepared a chart. Beside the name of each service, we have listed its average cost, speed of transfer, receiving countries, and our review score – sorted from highest to lowest.

To sort this chart by column, click its respective headings. If you are reading on mobile, you may need to scroll horizontally to view all fields.

| wdt_ID | Service | Ave. cost | Speed | Countries | Our score | Review |

|---|---|---|---|---|---|---|

| 1 | Azimo | 0.89% | 1-3 days | 200 | 2 stars | Read review |

| 2 | OrbitRemit | 0.43% | 1-3 days | 43 | 4 stars | Read review |

| 3 | Currencies Direct | 1.79% | 2-4 days | 188 | 3 stars | Read review |

| 4 | OFX | 1.20% | 3-5 days | 226 | 4 stars | Read review |

| 5 | CurrencyFair | 0.45% | 2-4 days | 157 | 5 stars | Read review |

| 6 | Paysera | 0.97% | 3-5 days | 174 | 3 stars | Read review |

| 7 | MoneyGram | 3.50% | 1-3 days | 194 | 2 stars | Read review |

| 8 | RationalFX | 1.16% | 1-3 days | 201 | 3 stars | Read review |

| 9 | Remitly | 0.77% | 1-3 days | 58 | 2 stars | Read review |

| 10 | Ria Money Transfer | 3.06% | 1-3 days | 158 | 2 stars | Read review |

If you would like to learn more about the rationale of our Skrill review, take a look at our review methodology.

Transfer speed

A typical transfer with Skrill Money Transfer takes 1-3 business days, from sending to receipt. The exact duration will depend on a few factors, including the currency pairings involved, the transfer value, as well as the particular systems of the sending and receiving bank.

Skrill payment options

How do payment features affect our Skrill review? Let’s take a look at its capabilities.

Spot contract

A spot contract consists of a single payment from one currency to another at the currently available exchange rate. If you need to send money right away, simply login to the Skrill app or website and with a couple of clicks a transfer can be arranged.

Skrill customer service number and support

Skrill customer service can be contacted by phone, Skrill support email, or through the use of a form on their website. Here are the Skrill customer service details for a couple of its offices:

+44 203 308 2520 (International)

+44 203 308 2519 (United Kingdom)

help@skrill.com

In our experience, we found Skrill customer service to be friendly and helpful. We did not have to wait too long to speak with someone on the phone, and our queries by email have been answered in a prompt and professional manner.

Is Skrill safe?

As a customer, is Skrill safe to use? Let’s take a look at some of its security measures.

Government regulated

Skrill is regulated by the Financial Conduct Authority in the UK and is licensed as an Electronic Money Institution under reference 900001. Its international subsidiaries are regulated by the relevant authorities in the jurisdiction of their operations, such as FinCEN in the United States.

Customer funds are held in trust

In accordance with the standards imposed by government regulators, the funds of Skrill customers are held in segregated accounts and are kept apart from the company’s own operating accounts. This ensures the security of customer funds, should Skrill encounter financial difficulty.

Website is securely protected

The Skrill website is protected with TLS encryption, which prevents sensitive data from being intercepted during your visit. You can confirm that this is in place by recognising a green padlock next to the website’s URL on your browser. Skrill has also implemented two-factor authentication.

Is Skrill legit? A look at its reputation

Is Skill legit or are there complaints of a Skrill scam? Let’s take a look at its reputation.

Trustpilot

As of publication, Skrill has received over 13,000 reviews on Trustpilot with an average rating of 4 out of 5 stars; representing a positive experience in 80 percent of interactions with its customers.

Here are our observations of the feedback posted:

Positive reviews

- Useful for countries not supported by other services

- An alternative to PayPal

Negative reviews

- Poor customer support

- High fees

- Long verification process

Social media

Upon viewing the Facebook and Twitter feeds of Skrill, we can see a range of interactions between the service and its customers. It appears that queries raised by customers on these platforms are addressed same-day.

Mainstream media

The mainstream media reporting of Skrill is generally positive. Most articles highlight the advantage of using money transfer apps over traditional banking services.

Tills ring for online payment service.

The Sunday TimesOnline pay pioneer in £600m sale.

The Sunday TimesSkrill mobile app and user experience

How does product design affect our Skrill review? Let’s take a look at the user experience.

Online platform

The Skrill website has been designed thoughtfully, with special attention being paid to user experience and functionality. It is available in 12 languages; English, Chinese, Czech, French, German, Greek, Italian, Polish, Romanian, Russian, Spanish, and Turkish.

Skrill mobile app

A Skrill mobile app has been developed for Apple and Android devices. By using the Skrill mobile app you can access your account at any time and use its core features, such as initiating new payments or tracking the status of in-progress transfers.

Registration process

The registration process is very quick and takes around 1 minute. All you need to do is enter your email address and a password.

Identification requirements

Before you can commence transferring funds with Skrill, you will first need to verify your identity. This will typically require providing two types of documents:

- Photo identification, such as a passport or drivers licence

- Skrill address verification, such as a bank or utility statement

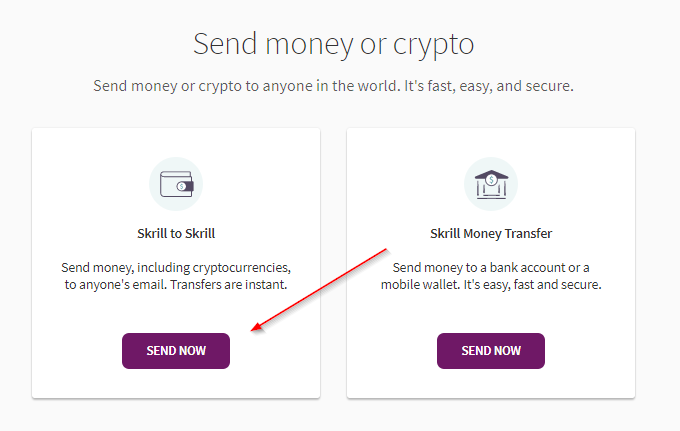

How to transfer money to Skrill account?

As a part of our Skrill review, we will take you through an example transaction. If you would like some guidance in navigating your own account, you can follow along below.

Step 1 – Sign up and login

Visit skrill.com and log in. To begin a transaction, click Send.

Step 2 – Select payment method

First, select how you want to transfer your funds. You can either send money from your Skrill wallet, a bank account or credit card.

Is Skrill Safe To Use

Step 3 – Select currencies

Select the country of your recipient and the currency denomination of their account. You will also need to select the delivery method. Click Continue.

Step 4 – Enter recipient details

Enter the personal information of your recipient, including their bank details if that is the delivery method chosen. Click Continue.

Step 5 – Confirm transaction

The terms of the quote are presented, and a reason for the payment is requested. Once you are happy to proceed, click Continue.

Step 6 – Enter payment details

You are provided with instructions to proceed with your part of the payment. Now is the time to enter your credit card details, or transfer your funds into the local bank account of Skrill.

Step 7 – Track payment

When your funds are received by Skrill, it will complete the final leg of the transfer. You can track its status online or with the Skrill mobile app. You will also receive email updates throughout the process.

All done!

Finally, once the transfer is complete its status will be updated accordingly. The funds should arrive in your recipient’s bank account shortly.

Review disclosure: Unfortunately, we were not able to test Skrill with a transaction of our own. As a result, we cannot confirm the efficacy of the service.

Skrill review: Final thoughts

Skrill Money Transfer provides a basic service for international money payments. Its has strong links to the cryptocurrency and gambling industries, and this drives much of its popularity. As far as Skrill’s money transfer service goes, however, it’s not one of the best options out there.

Is Skrill Safe To Use Reddit

The service is clunky, expensive, and has a reputation for poor customer service. As far as we can tell, there is nothing that Skrill does that other services don’t do better. With the availability of high-quality alternatives such as WorldRemit and TransferGo, it is difficult to recommend using Skrill.

Is Skrill Safe Reddit

If you have any questions or feedback about our Skrill review, let us know in the comments below.